An Unbiased View of Certified Accountant

Wiki Article

7 Easy Facts About Certified Accountant Described

Table of ContentsThe Accountants IdeasThe Fresno Cpa PDFsHow Certified Cpa can Save You Time, Stress, and Money.The 9-Second Trick For Certified AccountantWhat Does Accounting Fresno Do?Things about AccountantsCertified Accountant Fundamentals Explained

The greatest inquiry you should ask yourself, nevertheless, is: What is the ideal use your time? Also if you do your own accounting, it's very easy to get sidetracked by the many jobs and duties that pound you each day. As you multitask, there is also the chance of making mistakes along the method, such as a computation error or a missed deal.

Likewise, if all or the majority of your efforts are used in staying on top of tracking your expenses, other departments in your company will likely go unchecked. Without exact audit services, the remainder of your company can be negatively influenced. Various other difficulties little organizations face could consist of: As your business executes its services or generates products for customers, if you're not monitoring your receivables, you may encounter issues with not earning money for the job you're doing within a prompt manner.

Certified Cpa Fundamentals Explained

Adequate as well as prompt payroll could be the distinction between employing terrific talent as well as not obtaining off the ground in any way. If your company gets paid for the work it creates, your employees anticipate reciprocal repayment for the work they're doing to maintain business running. While making money from your accounts is essential, you likewise need to preserve a constant circulation to repay your suppliers., you desire to ensure you have the most current details on the books for smooth tax obligation preparation. Not just is maintaining track of every cost very in-depth, however you might also end up paying also much or missing out on out on useful deductibles.

If your books are unreliable, or no person is keeping a close eye on the pay-roll for consistency and also openness, you might face scams instances. A financial audit because of scams is the last thing your organization requirements. The very best and also easiest method to fix these usual bookkeeping obstacles is by working with an accountant you can trust to manage the details of your financial resources.

Some Known Details About Accounting Fresno

Accountants focus largely on keeping track of and arranging monetary purchases. An accounting professional takes a subjective appearance at your economic data as well as what that could suggest for your service.While the prices vary, you do wind up saving much more by employing an accountant that can carry out both jobs needed to run your organization. As you establish whether you intend to involve an accountant, check out the advantages of working with one. They can help you execute numerous vital tasks for your business such as: Obtaining more info here your business tax obligations all set as well as submitted.

Monitoring your cash circulation. Supplying suggestions on tax obligation preparation. Assembling a financial method. Creating certified monetary accounts and bookkeeping your firm's books. Accountants assist you keep your expenses prices down and also can make forecasts for what's to come economically in your business. From products essential for your workplace, the workplace itself, pay-roll, computer and software program therefore a lot a lot more, there are an entire host of costs to manage and also anticipate.

Fascination About Certified Accountant

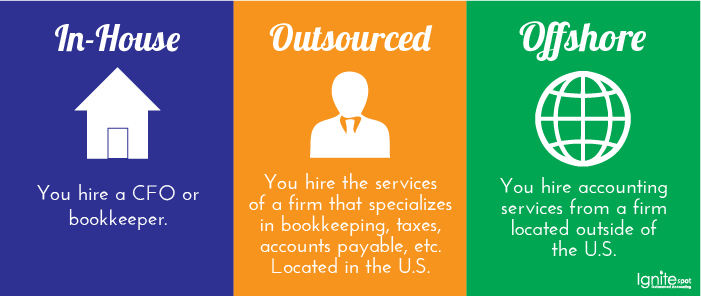

At the end of the month into newly resolved savings account and a fresh collection of monetary documents. After your last accountant put in their notification. If you observe you may be paying way too much for an internal accounting professional. Outsourcing your accounting professional can assist you keep your organization agile regardless of what financial or societal changes happen around you.

We have all of the proficiency you're looking for from payroll to organization advancement that can help your company thrive.

CPAs are accountants that are tax obligation professionals. Before you start your organization, you need to consult with a certified public accountant for tax advice on which organization framework will save you cash as well as the accountancy technique you need to utilize. If you're examined, a CPA can represent you before the IRS.As a small service owner, you may locate it challenging to evaluate when to visit site outsource responsibilities or manage them on your very own.

Get This Report on Accounting Fresno

While you can absolutely deal with the day-to-day bookkeeping yourself especially if you have excellent bookkeeping software program or work with a bookkeeper, there are instances when the know-how of a certified public accountant can help you make sound business decisions, stay clear of costly errors and also save you time. Certified public accountants are tax obligation professionals that can file your organization's tax obligations, response essential financial inquiries and also potentially conserve your business money.They need to take professional education and learning training courses to preserve their certificate, and may shed it if they are founded guilty of fraud, carelessness or values infractions. In addition, CPAs have endless representation legal rights to work out with the internal revenue service on your part. A certified public accountant is a customized sort of accountant with tax experience that can represent you prior to the IRS.

At the end of the month into recently reconciled financial institution accounts and a fresh collection of financial documents. After your last accountant placed in their notice. If you observe you might be paying way too much for an internal accounting professional. Outsourcing your accounting professional can aid you keep your company agile whatever economic or societal changes occur around you (certified cpa).

The smart Trick of Accounting Fresno That Nobody is Discussing

CPAs are accounting professionals that are tax obligation experts. Prior to you begin your service, you need to meet with a CPA for tax obligation advice on which service structure will certainly conserve you cash and also the accounting method you ought to use. If you're investigated, a CPA can represent you prior to the IRS.As a small look at here now company owner, you may locate it difficult to evaluate when to outsource duties or manage them by yourself.

Certified public accountants are tax professionals who can submit your company's tax obligations, answer essential financial concerns as well as possibly conserve your business money.

6 Easy Facts About Certified Cpa Shown

They should take professional education programs to keep their permit, and might lose it if they are founded guilty of scams, oversight or ethics violations. Furthermore, CPAs have endless representation rights to discuss with the IRS in your place. A certified public accountant is a specific kind of accountant with tax obligation know-how that can represent you prior to the IRS. fresno cpa.Report this wiki page